|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploring CRM Software for Mortgage Brokers: A Seamless Integration of Efficiency and PersonalizationIn the intricate world of mortgage brokerage, where client relationships and data management are pivotal, Customer Relationship Management (CRM) software emerges as a transformative tool. Designed to streamline operations and enhance customer interaction, CRM software provides a comprehensive platform for mortgage brokers to manage their business with greater efficiency and precision. The core function of CRM software in the mortgage industry is to consolidate all client information into a single, accessible database. This ensures that brokers have immediate access to vital data, enabling them to respond swiftly to client inquiries and stay updated on the status of each transaction. By automating routine tasks, CRM systems allow brokers to focus more on building client relationships rather than getting bogged down with administrative duties. A typical CRM solution for mortgage brokers includes features such as lead management, contact management, task scheduling, and email marketing automation. These tools help brokers track leads through every stage of the sales funnel, ensuring no potential client slips through the cracks. Moreover, the integration of email marketing tools enables brokers to maintain regular communication with clients, sending personalized updates and newsletters that enhance client engagement. Another compelling aspect of CRM software is its ability to generate detailed analytics and reports. Brokers can gain insights into their performance metrics, identify trends, and make data-driven decisions to optimize their operations. This analytical capability is invaluable for brokers seeking to understand their client base better and tailor their services accordingly.

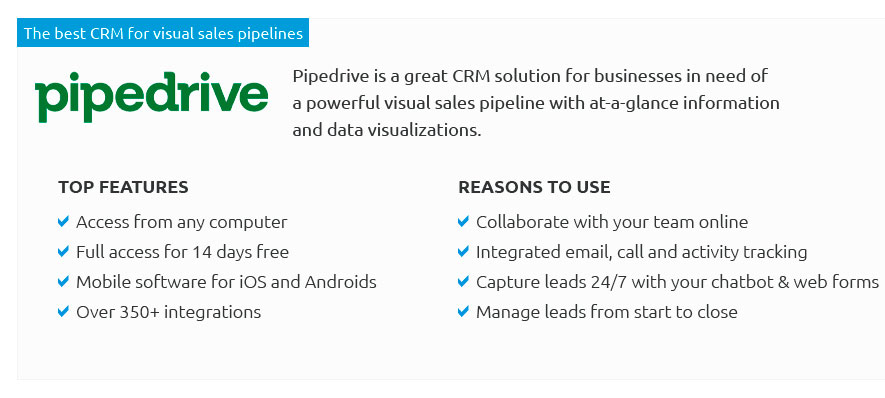

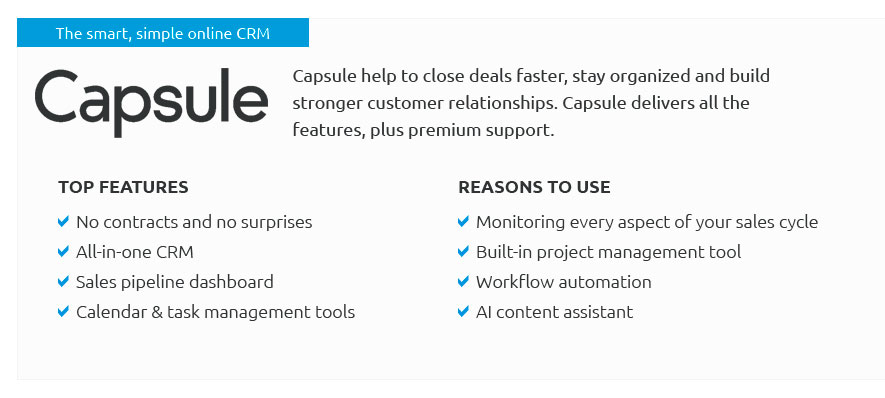

While the benefits of CRM software are numerous, it is essential for mortgage brokers to select a solution that aligns with their business goals. With a plethora of CRM options available in the market, choosing the right software can be daunting. Brokers should prioritize ease of use, scalability, and customer support when evaluating CRM solutions. Ultimately, the adoption of CRM software represents a significant step forward for mortgage brokers aiming to enhance their operational efficiency and client satisfaction. By leveraging the capabilities of CRM systems, brokers can provide a more personalized and responsive service, fostering stronger client relationships and driving business growth. In a competitive market, CRM software is not just a tool; it is an indispensable ally for success. https://brokerengine.com.au/features/

The next generation in loan comparison tools: build loan scenarios in minutes, including an accurate comparison of net costs over any two time frames. https://ascendix.com/blog/commercial-mortgage-crm-software/

Mortgage brokers use CRM systems to centralize and manage client interactions, automate tasks, track loans, ensure compliance with regulations, ... https://www.g2.com/categories/mortgage-crm

Best Mortgage CRM Software At A Glance ; Total Expert - Total Expert ; nCino's Mortgage Suite - nCino Opco, Inc. ; BNTouch Mortgage CRM - BNTouch, Inc ; Insellerate.

|